Most finance teams still struggle to find the right FP&A software, and about 80% of FP&A tasks happen in offline spreadsheets and databases. The numbers paint a clear picture – more than 85% of SMEs in the United States rely on spreadsheets for their critical financial processes like budgeting and forecasting.

The FP&A software market shows remarkable momentum. The global financial planning & analysis software market stands at USD 4.38 billion in 2024 and experts project it to reach USD 11.67 billion by 2033, with a 10.3% CAGR. These numbers make sense as FP&A tools have proven their worth – some organizations have cut their budget finalization time from 45 days to just three days.

Our analysis covers the top fp&a software tools in the market today. We help you pick the right solution for your organization. The list includes 15-year old players and innovative newcomers, with detailed insights into what each platform does best. Our ranking of the 15 best FP&A tools for 2025 guides you through options – from Excel alternatives to full-scale financial planning platforms.

FP&A Software Comparison: At Glance

A side-by-side comparison helps you choose the best fp&a software that fits your organization’s needs after we analyzed various FP&A solutions. Here’s a complete overview of these top financial planning tools:

| FP&A Software | Pricing Range | Standout Feature | Ideal For |

| Cube | USD 1,500-2,800/month | Excel/Google Sheets integration | SMBs transitioning from spreadsheets |

| Workday Adaptive | Custom pricing | Elastic Hypercube Technology | Mid-market (USD 50M-2B revenue) |

| Anaplan | ~USD 50,000/year | Real-time collaborative modeling | Large enterprises with complex structures |

| Planful | ~USD 43,423/year | AI-powered anomaly detection | Mid-market companies |

| Vena | USD 5,000-10,000/year | Excel-native interface | Excel-dependent finance teams |

| Prophix | USD 15,000-100,000/year | FP&A Plus | Construction, healthcare, manufacturing |

| Oracle Essbase | Custom pricing | Complex hierarchy modeling | Large enterprises with IT resources |

| Oracle Hyperion | USD 9,000+ per license | Multi-dimensional modeling | Organizations needing consolidation |

| Oracle PBCS | USD 120/user/month | Integrated statement planning | Quick-deployment seekers |

| NetSuite P&B | Custom pricing | ERP integration | NetSuite ecosystem users |

| DataRails | ~USD 24,000/year | Excel-based workflow | Teams wanting to keep spreadsheets |

| Jedox | Tiered subscriptions | AIssisted™ Planning | Excel users seeking enhancement |

| OneStream | ~USD 178,000/year | XF Marketplace | Large organizations replacing CPM apps |

| Centage | USD 950-3,500/month | Formula-free budgeting | Mid-sized organizations |

| Mosaic Tech | USD 22,200-35,776/year | Arc AI | Finance teams automating reporting |

15 Top FP&A Tools for 2025

Cube

Cube is a cloud-based FP&A platform that works natively with spreadsheets. It helps teams move beyond Excel limitations while meeting modern financial planning demands. Many finance teams want to avoid manual spreadsheet work but need flexibility. Cube gives them the perfect balance with better control and automation.

Cube key features

The platform’s four main capabilities improve financial operations:

- Seamless spreadsheet integration: Works bi-directionally with Excel and Google Sheets to keep your familiar processes

- Centralized data hub: Combines data from ERPs, CRMs, HRIS, and spreadsheets into one reliable source

- AI-powered analytics: Delivers smart variance analysis, AI-based forecasting, and conversational AI in Slack and Teams

- Multi-scenario modeling: Builds flexible forecasts and runs what-if scenarios without complex formulas

On top of that, it includes enterprise-grade security with SOC2 compliance and role-based access controls. These features make it perfect for organizations that need strict data governance.

Cube pros and cons

Pros:

- Cuts reporting time by up to 50% in some organizations

- Saves money (up to USD 300,000 yearly for some customers)

- Sets up new accounts 5x faster than competitors

- Includes unlimited users, templates, and dimensions

Cons:

- Detailed analysis has limited drilldown options

- Operating models are hard to upload and arrange

- Data transfer between dimensional structures becomes complex

- Growing companies might outgrow its features

Cube pricing

Cube uses a custom pricing model based on company size, data integration complexity, and specific needs as of 2025. Previous plans started at USD 1,500 monthly for small teams. Mid-sized companies paid USD 2,800 monthly, while enterprise pricing remained custom.

Cube best for

These organizations benefit most from Cube:

- Startups and small-to-medium businesses that need FP&A structure

- Teams dependent on Excel/Google Sheets who want automation but keep spreadsheets

- Companies that need to combine financial data from multiple sources

- Finance teams ready to move from manual tasks to strategic work

Workday Adaptive Planning

Workday Adaptive Planning stands out as a cloud-based planning and Corporate Performance Management (CPM) solution that helps companies with continuous, scenario-based planning. The platform serves around 7,000 customers in industries of all types since Workday acquired Adaptive Insights in 2018.

Workday Adaptive Planning key features

The platform’s foundation is its Elastic Hypercube Technology, an in-memory processing engine that scales computing power automatically when needed. The platform offers four main capabilities:

- Financial Planning: Has budgeting, forecasting, scenario planning, analytics, and strategic planning tools

- Workforce Planning: Has headcount tracking, cost analysis, and talent allocation features

- Operational Planning: Supports sales, demand/supply, project, and marketing planning

- Close and Consolidation: Makes shared period close management and global financial data consolidation possible

The platform uses Workday Illuminate, their AI/ML technology that powers anomaly detection, outlier coverage, and predictive forecasting.

Workday Adaptive Planning pros and cons

Pros:

- Cuts planning cycle times by 70% and boosts productivity by 50%

- Blends with over 300 different systems including CRMs and HR software

- Has industry-specific templates and functionality

- Easy-to-use interface that users appreciate

Cons:

- High implementation costs and steep learning curve

- Unclear pricing structure makes final costs uncertain

- Enterprise features might overwhelm smaller teams

- Customer support quality has dropped since acquisition

Workday Adaptive Planning pricing

Workday offers two subscription plans with prices that vary based on business requirements. A 30-day free trial is available for the base planning subscription. The two paid options are:

- Workday Adaptive Planning: Has connectivity with ERP/GL systems, unlimited versions for scenarios, and unlimited what-if scenarios

- Workday Adaptive Planning & Consolidation: Adds close and consolidation capabilities to the base package

Workday Adaptive Planning best for

Mid-market companies with revenues between USD 50M and USD 2B benefit most from Workday Adaptive Planning. The solution works best for organizations with:

- Complex, multi-entity structures that need sophisticated consolidation

- Teams moving away from spreadsheet-based planning

- A need for cloud-native solutions with strong IT support

Boston Scientific, Major League Baseball, Hitachi, and the University of Arizona are some of their prominent enterprise users.

Anaplan

Anaplan stands as a Leader in the 2024 Gartner Magic Quadrant for Financial Planning Software, maintaining this position for three straight years. The company’s cloud-native platform strengthens organizations through up-to-the-minute data analysis and connected planning across finance, HR, and supply chain departments.

Anaplan key features

The platform’s core strengths lie in its resilient infrastructure for connected planning:

- Real-time collaborative modeling: Teams can work together on a shared model to create a single source of truth

- What-if scenario planning: Quick analysis of multiple scenarios helps teams evaluate best-case, worst-case, and custom situations

- No-code interface: Business users can build and maintain complex models without IT support

- Dynamic dashboards: Visual insights lead to better decision-making

- Hyperblock calculation engine: Multi-dimensional analysis runs smoothly with unlimited constraints through in-memory processing

The software includes advanced forecasting tools, secure data hosting, workflow capabilities, and seamless connections with major systems like Salesforce.

Anaplan pros and cons

Pros:

- Planning cycles run faster and finance team’s output improves by up to 40%

- Business processes adapt well to customization needs

- Data security measures ensure authorized access only

- Global operations benefit from multiple currencies, languages, and regional formats

Cons:

- Large datasets slow down supply chain forecasting

- AI/ML features lag behind competitors

- Version control lacks built-in undo options

- Users need extensive training with over 60 hours of video content

Anaplan pricing

Standard plans start around USD 50,000 yearly, though enterprise costs can run substantially higher. Project implementation takes 8-24 weeks with additional costs ranging from USD 50,000-250,000 based on complexity.

Anaplan best for

The platform serves these organizations best:

- Large enterprises with complex financial structures and worldwide operations

- Companies that need integrated planning across finance, HR, and supply chain

- Businesses requiring advanced scenario modeling

- Organizations ready to move from Excel to dynamic, connected planning

Planful

Planful reshapes the scene of financial planning with its cloud-based technology. The platform helps more than 1,000 customers optimize their budgeting, forecasting, and reporting processes.

Planful key features

Planful’s complete financial performance platform includes:

- AI-powered insights: Detects anomalies, surfaces errors, and flags potential risks using machine learning

- Financial planning: Comes with pre-built templates and built-in financial intelligence to speed up planning

- Financial close management: Cuts close times by up to 80% by automating month-end processes

- Dynamic planning engine: Supports operational planning with multi-dimensional analysis

- Reporting automation: Creates custom and drill-through reports that guide decision-makers

The platform keeps data secure through role-based security, audit reporting, and strong verification features.

Planful pros and cons

Pros:

- Cuts monthly close time by up to 80% based on case studies

- Saves USD 2.40 Million annually in one case

- Saves about one week each month

- Works well with Excel through the Spotlight plugin

- Supports multi-dimensional data analysis

Cons:

- Users find it hard to learn and call it “non-intuitive”

- Data retrieval can be frustratingly slow

- Outdated user interface makes navigation difficult

- Implementation costs are high and often needs third-party consultants

- Customer service quality gets mixed reviews

Planful pricing

The platform doesn’t list public pricing. Third-party data shows a median contract value of USD 43,423 per year, based on 48 purchases where buyers saved 15% on average. Multi-year contracts are standard, and customers can get discounts up to 50%.

Planful best for

Mid-market companies use Planful to:

- Simplify complex financial processes across entities

- Cut down manual planning tasks

- Help finance and operational teams work better together

- Speed up forecasting and reporting

Boston Red Sox, Del Monte, TGI Friday’s, and 23andMe are some of Planful’s notable clients.

Vena

Vena stands out in the FP&A world by blending Excel’s familiar interface with enterprise-grade planning tools. This allows finance teams to keep their spreadsheet expertise while accessing advanced features.

Vena key features

Vena’s platform has these powerful capabilities:

- Excel-native interface: Users keep their familiar spreadsheet environment with added enterprise controls and automation

- Centralized cloud database: The total data from multiple source systems unites into one reliable truth source

- AI-powered insights: Vena Copilot delivers FP&A insights through Microsoft Teams integration

- Workflow automation: Templates get distributed by entity/department with controlled submission processes

- Pre-built templates: The platform has financial statements, revenue planning, and cash flow templates

Vena pros and cons

Pros:

- Budget cycle times drop substantially through automated unification

- Strong integration exists with Microsoft 365 and Power BI

- Users get extensive audit trails and version control capabilities

- Dedicated success managers provide responsive customer support

Cons:

- Implementation takes long, usually 8-10 weeks or more

- Templates load slowly, taking 2-3 minutes

- The pricing model runs high with extra implementation fees

- Users need coding knowledge for third-party BI tools

Vena pricing

Vena has two main pricing tiers without public rates:

- Professional: Basic option starts at USD 5,000/year

- Complete: A complete package with extra features starts at USD 10,000/year

Implementation costs range from USD 10,000 to USD 30,000+.

Vena best for

Vena works best for:

- Medium to large enterprises with Excel-dependent finance teams

- Companies wanting to keep spreadsheet investments while adding governance

- Finance departments that need strong audit capabilities and compliance features

- Multi-entity businesses looking for united financial views

Prophix

Prophix started as a software distributor in 1987 and grew into a strong Financial Performance Platform that now serves more than 3,000 customers in over 100 countries.

Prophix key features

Prophix One provides these detailed capabilities to finance teams:

- FP&A Plus: Handles complex calculations and large datasets quickly and precisely

- Automated workflows: Makes budget approvals and report distribution more efficient

- Advanced data processing: Speeds up planning cycles while improving accuracy

- Strategic cash flow forecasting: Offers advanced modeling tools to help navigate through change

Prophix pros and cons

Pros:

- Boosts budget accuracy by 50% in documented cases and leads to 6.7% operating margin increases

- Acts as a “Source of Truth” by centralizing all core financial information

- Provides excellent customer support through dedicated success teams

- Combines smoothly with ERP systems and Excel

Cons:

- New users face a steep learning curve

- Complex balance sheets and cash flow forecasts take time to process

- Report-building isn’t as user-friendly as Excel

- Complex models need creative solutions to reduce processing time

Prophix pricing

The platform uses a subscription model with 1-5 year contracts paid yearly. Contract length, number of users, data integration complexity, and extra services determine the final cost. Yearly subscriptions cost between USD 15,000 and USD 100,000.

Prophix best for

Finance teams in construction, healthcare, manufacturing, higher education, and professional services will find Prophix valuable to change their financial processes.

Oracle Essbase

Oracle Essbase works as a multidimensional database management system (MDBMS) that simplifies complex financial planning through OLAP (Online Analytical Processing) technology for data analytics.

Oracle Essbase key features

Oracle Essbase provides powerful analytical capabilities through:

- Advanced calculation engine with over 350 prebuilt functions that model complex business scenarios

- What-if analysis to forecast performance and model multiple scenarios

- Complex hierarchy modeling that represents detailed business structures

- Excel integration via Smart View for Mac and browser-based interfaces

- REST API to automate management of Essbase resources

- Hybrid BSO cubes that combine Block Storage and Aggregate Storage capabilities

Oracle Essbase pros and cons

Pros:

- Manages large datasets with stability and adaptability

- Makes sophisticated dimensional analysis possible

- Combines smoothly with Hyperion Planning and other systems

- Lets users customize their reporting needs

Cons:

- Calculation scripts can take hours to run

- Fewer forecasting functions than dedicated FP&A solutions

- Setup requires specialized skills and expertise

- Users need to handle financial consolidation manually without a dedicated module

Oracle Essbase pricing

Oracle Essbase sets custom prices based on each business’s needs. The company does not publish standard rates or offer free plans.

Oracle Essbase best for

Oracle Essbase serves business users at large enterprises that have strong IT resources. These organizations typically have reliable FP&A solutions and use Oracle’s back-office products.

Oracle Hyperion

Oracle Hyperion serves as a unified planning, budgeting, and forecasting solution. It blends financial and operational planning processes to improve business predictability.

Oracle Hyperion key features

Oracle Hyperion comes with powerful capabilities that optimize financial operations:

- Accelerated planning cycles – Planning, budgeting, and forecasting cycles are reduced by weeks or months

- Excel-based interface – Users learn quickly through Microsoft Office’s familiar environment

- Complete consolidation – Financial results consolidate and report rapidly

- Multi-dimensional modeling – Complex financial calculations work with minimal IT help

- Workflow automation – Dynamic dashboards replace manual checklists for quick response

Oracle Hyperion pros and cons

Pros:

- The platform scales well and delivers high return on investment

- Data integrates smoothly from systems like SAP and SQL Server

- Businesses can customize features to match their needs

- Automated processes cut down manual work by a lot

- Financial analysis works better compared to tools like Excel

Cons:

- The security model needs better disaster recovery options

- Users face stability problems with poor technical support

- Setup and configuration prove too complex

- Guides and documentation need more detail

- The pricing structure costs more than competitors and lacks flexibility

Oracle Hyperion pricing

A single Oracle Hyperion license costs $9,000 per year. Custom pricing depends on business needs.

Oracle Hyperion best for

Large enterprises benefit most from Oracle Hyperion when they need:

- Financial consolidation across multiple entities

- Integrated budgeting and forecasting capabilities

- Resilient financial analytics and reporting

- A move away from spreadsheet-based planning

Major companies like Coca-Cola, Sony, Johnson & Johnson, and Dell Technologies use Oracle Hyperion.

Oracle PBCS

Oracle Planning and Budgeting Cloud Service (PBCS) was the first Oracle EPM product to move to the cloud. The service provides enterprise-wide planning capabilities built on proven Hyperion Planning technology.

Oracle PBCS key features

PBCS provides these complete capabilities for financial teams:

- Microsoft Office integration through Smart View for Excel, Word, Outlook, and PowerPoint

- Integrated financial statement planning across income statements, balance sheets, and cash flow statements

- Predictive planning tools that generate statistically modeled forecasts within web forms

- Flexible deployment options that support both cloud-only and hybrid implementations

- Rapid implementation with minimal hardware investment and IT maintenance

Oracle PBCS pros and cons

Pros:

- Planning cycles run faster with centralized data

- Smart View integration offers a familiar Excel interface

- Users can perform ad-hoc analysis with pivotable dimensions

- Deployment happens quickly without infrastructure investments

Cons:

- Customization needs substantial time investment

- The platform lacks pre-built content unlike its enterprise version

- Users can deploy only one core planning application

- The cost runs higher than competitors with similar features

Oracle PBCS pricing

The subscription costs USD 120.00 per user monthly. The enterprise version (EPBCS) costs USD 250.00 per user monthly.

Oracle PBCS best for

PBCS works best for organizations that:

- Want quick deployment with minimal infrastructure maintenance

- Plan to evaluate Oracle EPM before larger investments

- Don’t have dedicated IT teams for on-premises solutions

- Need applications they can customize easily

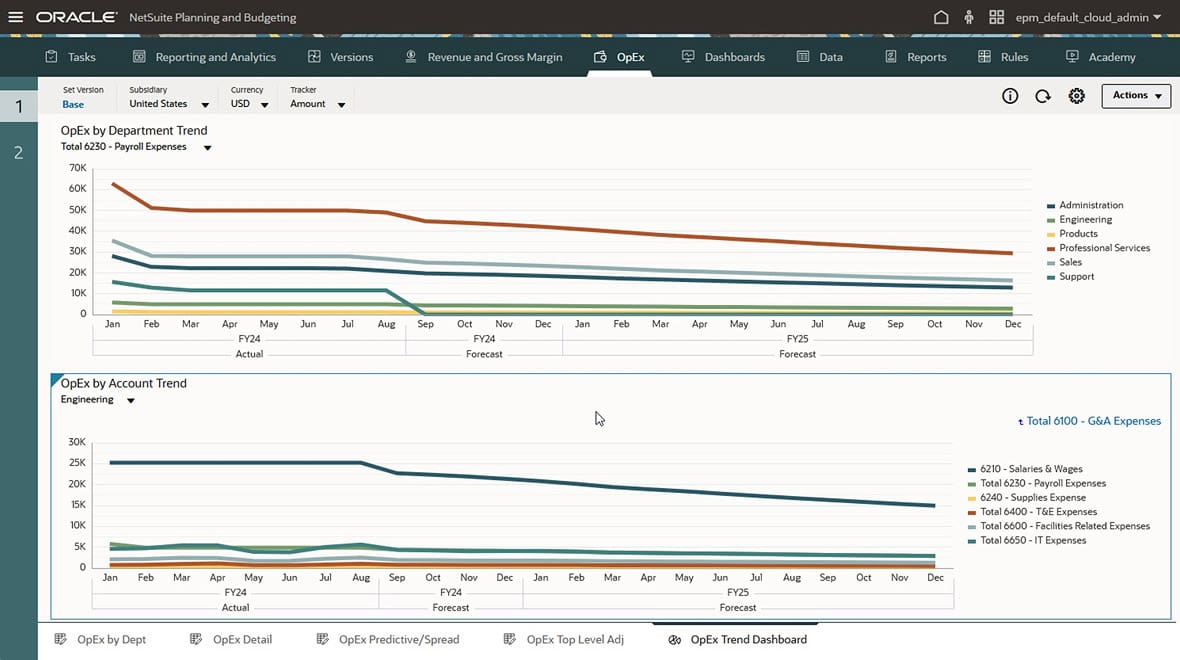

NetSuite Planning and Budgeting

NetSuite Planning and Budgeting works hand in hand with NetSuite ERP. It simplifies planning processes that used to take hours of manual work. This lets finance teams spend more time on strategic analysis instead of data entry and formula updates.

NetSuite Planning and Budgeting key features

- Embedded AI and machine learning that automates data analysis and writes detailed commentary to speed up forecasting

- Scenario modeling capabilities that help plan across location, product, customer, or expense categories

- Automated workflows with prebuilt templates to track approvals and reviews

- Microsoft Office integration through Smart View, which lets you run what-if analyzes in Excel

- Workforce planning tools that connect your company’s goals with headcount and compensation planning

NetSuite Planning and Budgeting pros and cons

Pros:

- Planning cycles become shorter with automatic syncing to NetSuite financials

- You get live forecasts within minutes based on actual ERP data

- Planning activities come together in one place to boost team alignment

- Predictive algorithms and continuous updates make forecasts more accurate

Cons:

- You need to invest time to set it up and configure it right

- Implementation services cost extra beyond the base subscription

- Users who switch from spreadsheets need time to adjust

- The Standard edition doesn’t offer as much customization as Premium

NetSuite Planning and Budgeting pricing

This add-on module for NetSuite uses subscription pricing with three parts: core platform, optional modules, and user count. You’ll also pay a one-time setup fee. Companies with $5-20M revenue can use the Standard edition, while those above $20M need the Premium edition.

NetSuite Planning and Budgeting best for

We designed this tool for businesses already using NetSuite who want to move away from spreadsheet planning. It works great for growing companies that need better financial control and a united view of all their entities.

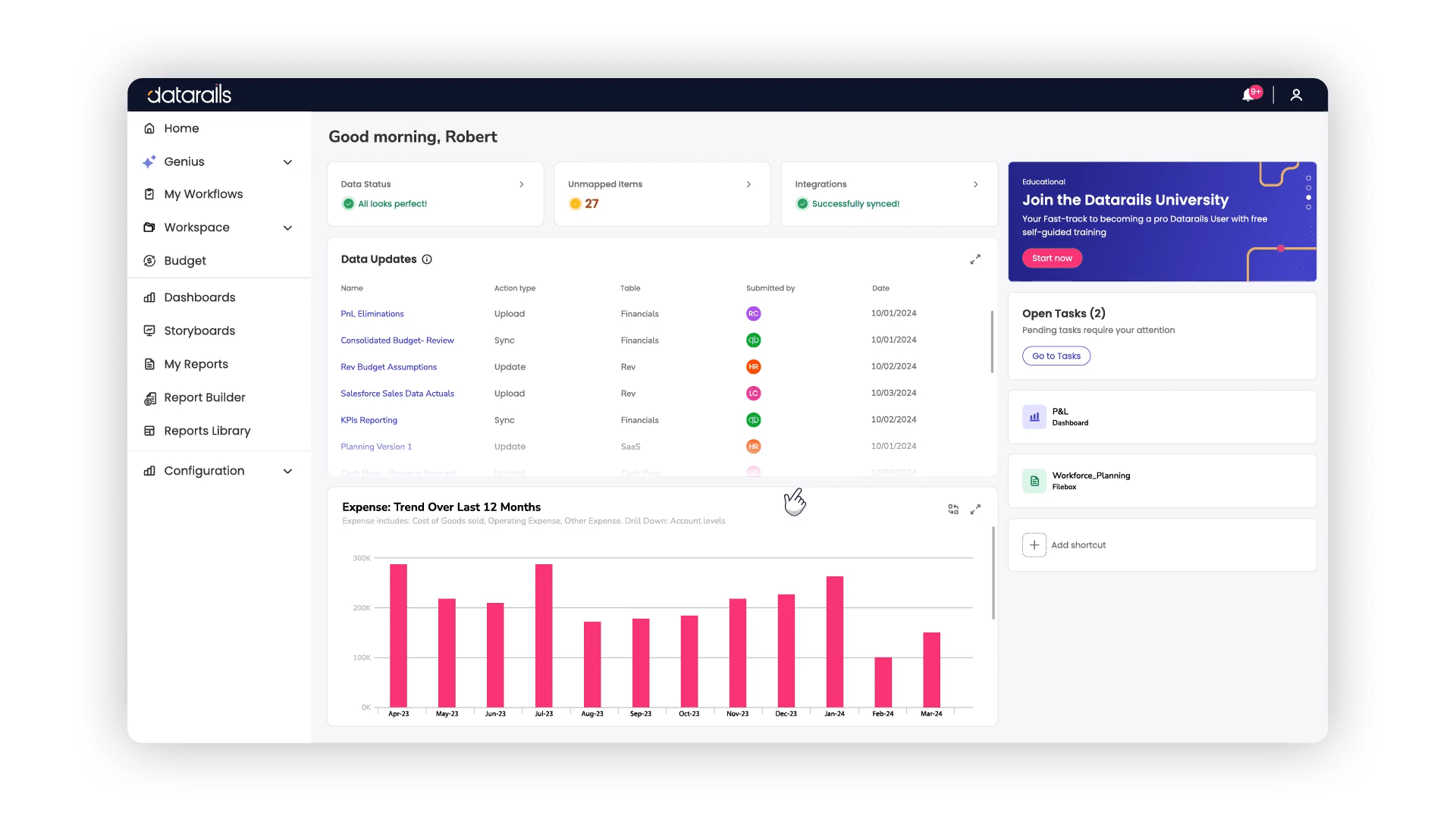

Datarails

DataRails turns Excel into a strong FP&A platform. Finance teams can keep their spreadsheets and eliminate manual data handling tasks.

Datarails key features

DataRails blends Excel’s familiar interface with enterprise-grade capabilities:

- AI-powered assistant (FP&A Genius) that analyzes data and generates insights

- Integration with over 200 systems including ERPs, CRMs, and accounting software

- Automated data consolidation that keeps your Excel models intact

- Visual tools to help you identify trends and anomalies quickly

- Scenario modeling to evaluate different financial outcomes

Datarails pros and cons

Pros:

- Data consolidation time drops by 75%

- Teams save 50 hours each month

- USD 500K in productivity costs stay protected

- Version control creates one reliable source of truth

- Teams can work together live without leaving Excel

Cons:

- Microsoft’s VBA serves as the underlying technology

- License structure might limit collaboration

- Users need to learn Datarails-specific formulas

- Price points exceed similar solutions

Datarails pricing

Custom pricing packages depend on your specific needs, number of users, and required integrations. Yearly contracts begin at USD 24,000.

Datarails best for

Small to mid-sized businesses that want to keep Excel while adding automation features will find DataRails valuable. Finance teams can eliminate spreadsheet errors without learning completely new systems.

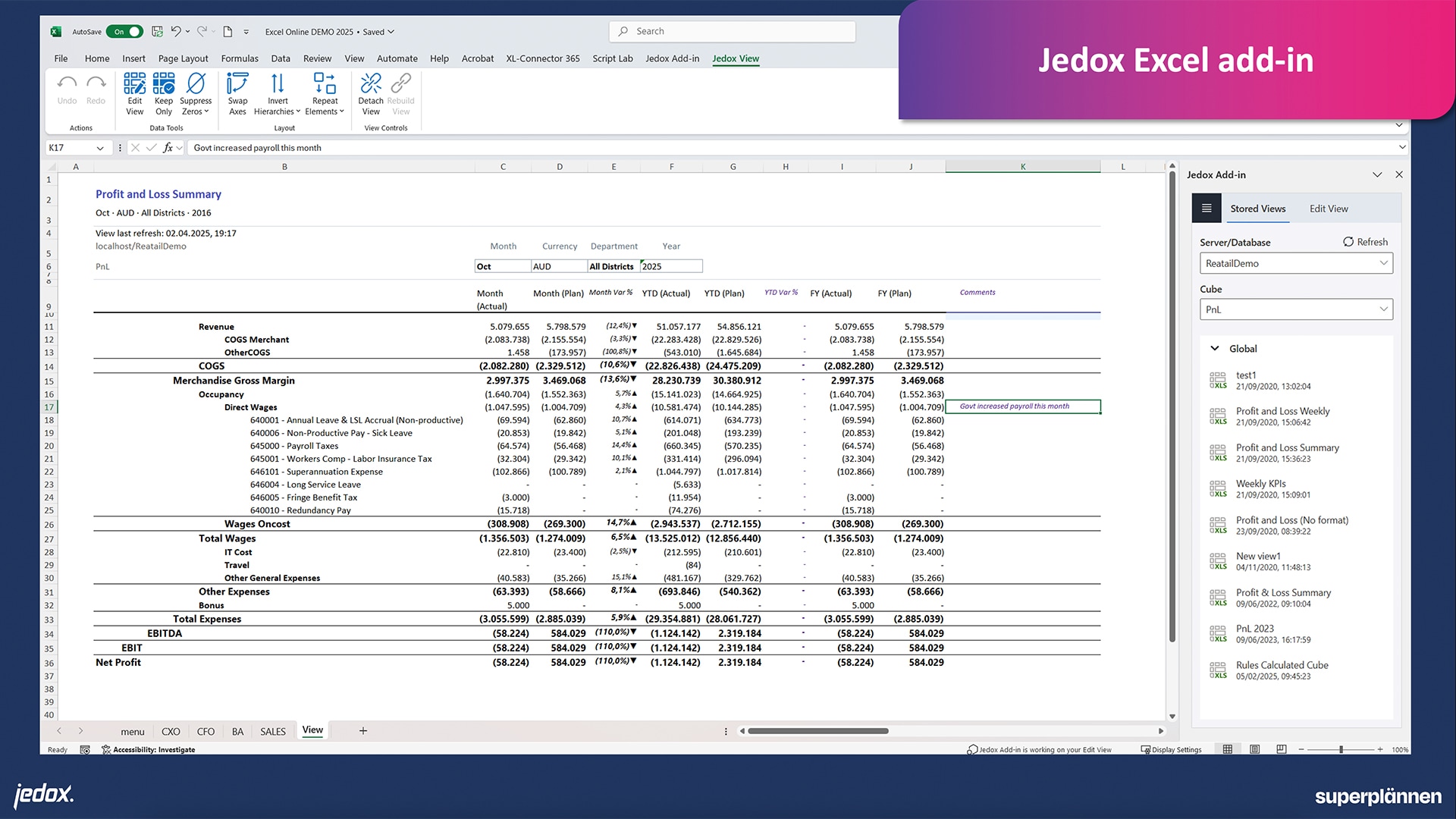

Jedox

Jedox stands out as a highly flexible planning and performance management platform. More than 2,900 organizations rely on it to optimize their financial processes and make better decisions.

Jedox key features

Finance professionals benefit from these powerful Jedox capabilities:

- Excel-like interface with a familiar Add-in that needs minimal training

- AIssisted™ Planning uses artificial intelligence to find insights that other FP&A software might miss

- Data integration connects almost any source to build a unified planning environment

- Best Practice Accelerator offers ready-to-use models that users can quickly customize

- Ad hoc reporting shows live data views from all entities

Jedox pros and cons

Pros:

- Serves as the single source of truth for all financial and non-financial data

- Cuts planning cycles down from weeks to days

- Makes data collection from multiple locations easier

- Works well with both centralized and decentralized analysis

Cons:

- Data entry proves more complex than regular Excel

- Users might need help from external service providers for some tasks

- Performance slows down with very large datasets

- Some users find the interface less user-friendly

Jedox pricing

The platform comes with tiered subscription packages (Essential, Business, Professional, and Performance) and three user types:

- Full Users: Complete platform access

- Planners: Budget and forecast focus

- Viewers: Report access only

Jedox best for

Organizations from manufacturing, retail, financial services, and healthcare sectors choose Jedox to improve their Excel-based workflows with enterprise-grade features.

OneStream

OneStream brings financial and operational data together in a single platform. The company started in 2009 and began its operations in 2011 after completing research and development.

OneStream key features

The platform provides a complete financial management solution:

- Unified Finance Platform integrates consolidation, reporting, planning, and analysis

- XF Marketplace includes 30+ downloadable solutions for specific finance needs

- Extensible Dimensionality lets users set different detail levels for various reporting purposes

- AI Agents launched in May 2025 come with Finance Analyst, Operations Analyst, Search Agent, and Deep Analysis tools

OneStream pros and cons

Pros:

- The platform creates thousands of accurate ML forecasts for products and locations

- Business insights like promotions and external factors become part of the forecasts

- Demand forecasts align with driver-based plans throughout financial statements

- Complex financial processes become simpler with robust reporting features

Cons:

- Setting up the system takes extra time due to unique business needs

- Smaller businesses might find the pricing too expensive

- The company serves 1,300+ global customers but has limited market presence

- Small companies that need basic financial planning find it too complex

OneStream pricing

OneStream’s annual cost averages USD 178,000, based on Vendr transaction data. Some customers pay up to USD 290,000. Users can choose flexible pricing based on their needs.

OneStream best for

Large organizations will benefit most when they want to:

- Replace multiple CPM applications that work in isolation

- Combine financial consolidation with planning processes

- Help finance teams focus on strategic business value instead of data management

Centage

Centage brings together budgeting, forecasting, reporting, and scenario planning on a single platform. The software caters to organizations where staff costs drive financial results.

Centage key features

This easy-to-use FP&A software comes packed with capabilities:

- Automated financial statements that create balance sheets and cash flow projections

- Workforce planning tools with direct payroll data connections

- Workflow collaboration to replace email chains with permission-based tasks

- Scenario modeling to quickly create best-case and worst-case projections

- Multidimensional budgeting that lines up with chart of accounts and workforce assumptions

Centage pros and cons

Pros:

- Built-in business logic removes the need for manual formula entry

- Works with almost any GL or ERP platform

- FP&A expert advisors help with setup and training

- More than 10,000 users trust the platform

Cons:

- Data entry is more complex than Excel

- Users need time to adjust from spreadsheet planning

- Some reporting features have limited customization options

- Premium features cost extra

Centage pricing

Centage comes in three subscription tiers:

- Core: USD 950/month – Perfect for teams moving away from Excel

- Strategic: USD 1,950/month – Includes shared planning tools

- Performance: USD 3,500/month – Full suite with advanced workforce planning

Centage best for

The platform serves mid-sized companies in healthcare, manufacturing, nonprofits, retail, and technology. It helps organizations ready to upgrade from spreadsheets to better budgeting and forecasting tools.

Mosaic Tech

Mosaic Tech is a strategic finance platform that connects financial and operational data throughout organizations. Teams can spend less time on repetitive tasks and focus more on accelerating growth.

Mosaic Tech key features

Mosaic gives you a complete view of your business data through:

- Automated dashboards that show financial model results immediately

- Arc AI that spots performance drivers and creates board-ready presentations

- Metric Builder with 150+ ready-to-use metrics or custom options

- Shared budgeting that lets business partners forecast expenses and headcount

- Scenario planning tools to evaluate multiple financial outcomes

Mosaic Tech pros and cons

Pros:

- Teams save over 40 hours each month on consolidations and reporting

- Companies see exceptional ROI within 90 days

- Analysis happens 7x faster for models and ad hoc reports

- Strategic planning based on insights increases by 60%

- Companies save about $500k in short-term hiring costs

Cons:

- Setup time can run longer than expected

- We designed it mainly for SaaS business models

- New users face a steep learning curve

- Metric customization has some limits

- Data export comes in limited formats

Mosaic Tech pricing

The platform offers three tiers: Analytics ($23,000 annually), Foundation ($22,200 annually), and Growth ($35,776 annually). Most companies receive discounts between 24-39%. Extra users cost $600-$850 each, depending on volume.

Mosaic Tech best for

Mosaic costs the same as 1.5 financial analysts. Small finance teams (0-50 FTEs) who want to automate their metrics and reporting will find it valuable. Larger teams (51+ FTEs) can use it to build strategic finance foundations or expand to advanced workflows.

Key Takeaways

Despite 80% of FP&A tasks still being done in spreadsheets, modern FP&A software can dramatically transform financial operations and strategic decision-making.

• FP&A software delivers massive time savings – reducing budget finalization from 45 days to just 3 days and cutting reporting time by up to 50%

• Excel-native solutions ease transition pain – tools like Cube, DataRails, and Vena preserve familiar spreadsheet workflows while adding enterprise controls

• Pricing varies dramatically by organization size – from Centage’s $950/month for SMBs to OneStream’s $178,000 annually for large enterprises

• Implementation timelines range from weeks to months – cloud solutions like Oracle PBCS offer rapid deployment while complex platforms require 8-24 weeks

• Integration capabilities determine success – seamless connections with existing ERPs, CRMs, and accounting systems are crucial for adoption

The FP&A software market is exploding with 10.3% annual growth, projected to reach $11.67 billion by 2033. Success depends on matching your team’s technical expertise, budget constraints, and scalability needs with the right platform’s capabilities.

FAQs

Q1. What are the key benefits of implementing FP&A software?

FP&A software can significantly reduce planning cycles, increase productivity, and improve forecast accuracy. Many solutions offer features like automated data consolidation, scenario modeling, and AI-powered insights that free up finance teams to focus on strategic analysis rather than manual data entry.

Q2. How do Excel-native FP&A solutions differ from standalone platforms?

Excel-native solutions like Cube and DataRails allow finance teams to maintain familiar spreadsheet workflows while adding enterprise-grade controls, automation, and collaboration features. Standalone platforms often require more extensive training but may offer more advanced capabilities for large enterprises.

Q3. What factors should be considered when choosing FP&A software?

Key considerations include your organization’s size and complexity, existing tech stack integration needs, budget constraints, implementation timeline, and specific functional requirements like financial consolidation or workforce planning. It’s also important to evaluate the vendor’s support quality and long-term viability.

Q4. How much does FP&A software typically cost?

Pricing varies widely based on organization size and feature requirements. Small business solutions may start around $950/month, while enterprise-grade platforms can cost over $100,000 annually. Many vendors offer tiered pricing models and custom quotes based on specific needs.

Q5. What are some emerging trends in FP&A software?

Key trends include increased AI and machine learning capabilities for predictive analytics and anomaly detection, improved data visualization tools, enhanced mobile accessibility, and tighter integration with operational planning across departments like sales and HR.